Few things are more crucial for internet businesses than the Digital onboarding procedures for user online. You invest a lot of money into getting people to visit your website, and many companies dedicate entire departments to optimizing it so that visitors turn into customers. Nothing could be further from the truth: the onboarding phase is essential not only for your customer journey but also for fraud and risk reasons. It goes without saying that businesses want onboarding to be as quick and frictionless as possible while still remaining compliant with the regulations in their industry and market.

A fully online business approach appears to have many benefits. You may work around the clock, reach a worldwide audience, and exert greater control over the data. But verifying people’s identities is one area where conventional brick-and-mortar arrangements excel. This is the same problem that the current digital client onboarding process is trying to solve.

Let’s examine how it functions, what are its benefits, and how to make it a streamlined onboarding solution without drawing scammers.

What Is Digital Onboarding?

The procedure through which firms add or acquire new users online is known as digital customer onboarding. However, since it is digital, it cannot happen in-branch or on-premise. Instead, it can happen on websites or in apps.

Since staff personnel cannot personally contact these users, it is crucial to implement security protocols to confirm the users are who they claim to be.

We are now used to taking selfies or uploading photos of our IDs during digital onboarding thanks to the proliferation of smartphones with high-quality cameras. Although this is expected and required in the financial services industry, it can be viewed as excessive in other fields. Users of your service are eager to utilise it, but they may not feel comfortable giving you access to their personal information.

What we are talking about is biometric identity verification, a form of hard KYC check. Hard because historically it’s hard to beat and creates extreme amounts of friction for your users.

How Does Digital Onboarding Work?

Digital onboarding is a method of customer acquisition that is entirely conducted online. The user merely registers for your service using their device, filling out the essential information step by step. The onboarding procedure was created with usability in mind, but it also complies with the criteria for Know Your Customer (KYC) and Customer Due Diligence (CDD).

Digital Onboarding, in its most basic form, enables you to convert online customers or clients into service users or customers in exchange for their personal information at signup, which enables you to verify their identity.

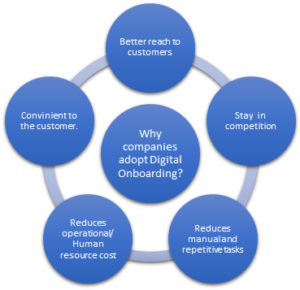

What are the benefits of Digital Onboarding?

Digital onboarding allows you to engage with potential consumers more directly because online surfing, whether done through the web or applications, is a genuine interest-driven activity.

- Learning more about them is one aspect of this (via steps like KYC checks as well as digital footprinting)

- An opportunity to market directly to consumers via emails and other correspondence, making purchases and queries easy.

- Enabling businesses to monitor consumer trends, making clients feel cared for, and, if necessary, completing KYC, CDD, and AML compliance screenings.

- Any company that wants to service clients online can utilise digital onboarding, but e-tailers, online merchants, and financial institutions who exclusively operate online need to use it more than anybody else because they have no other way to sign up users.

- Additionally, it is utilised in the onboarding process of new employees to manage remote workers, cut down on paperwork, and/or handle employee data electronically.

How do you create a frictionless Digital Onboarding Process?

Friction in the regular onboarding procedures is evident, and it is also clear that the key to successful onboarding is striking a balance between security and user experience. Increasing your user base as rapidly and simply as possible is something you want to do, but you don’t want the door to be left wide open so that anyone may enter.

For your digital onboarding, versatile and customizable security technologies are the solution. The reduction of fraud will be aided by a balance between light and extensive KYC procedures that doesn’t put individuals with clean records at a disadvantage.

Due to this, Digital Onboarding solutions usually come integrated with a wide range of technologies, including automated flagging during the identity verification stage and machine learning-assisted decision-making for identity proofing, which gives companies complete control over risk thresholds during the digital onboarding experience.

Herein lies the essential balancing act: You can be sure that you will never have to pay an AML or KYC fine if you add too many verification processes. However, if you make it too strict, users will search elsewhere. Deploying a better KYC compliance procedure that provides you complete control over the level of friction without compromising security is the key.

Why is Digital Onboarding transforming Businesses?

Financial companies have benefited from this ground-breaking new technology and its regulatory framework. First off, this technology is user-friendly, transforming a time-consuming and complex process into one that happens instantly. On the other hand, Video KYC through digital onboarding enables real-time verification because digital onboarding solutions have integrated machine learning and artificial intelligence into the KYC (Know Your Customer) procedure.

The adoption of onboarding solutions has demonstrated that businesses adopting this technology for customer acquisition have drastically raised their conversion rates. Due to the fact that this new system conforms to the strongest video identification security standards, customers are also protected against fraud.

With the use of Identity Verification using digital onboarding technology, 9 out of 10 banks have been able to increase their customer acquisition by 84%.

Digital onboarding reduces the traditional onboarding procedure, which often takes 3 weeks or more, to 3 minutes or less. Significant amounts of time are saved by both staff and consumers, which lowers bureaucracy and prevents the loss of potential clients in the latter phases of the client-acquiring process. All of these elements have made it possible for these businesses to lower operational expenses and boost sales.

Additionally, this is a secure and safe way for businesses to complete remote KYB onboarding with the use of Digital Onboarding.

Try IDcentral’s Digital Customer Onboarding and Intelligent Identity Verification Solution