UPI Verification

UPI or Unified Payments Interface is an instant real-time payment system developed by the National Payments Corporation of India (NPCI). UPI has revolutionized the way people make digital payments in India. The convenience of UPI transactions has led to an increasing number of people using it for their daily payments. However, with the increasing use of UPI, there is a need for people to understand how to verify their UPI transactions to ensure the security of their money. In this blog, we will discuss the process of UPI verification and its importance.

What is UPI Verification?

UPI verification is the process of verifying a UPI transaction to ensure its authenticity and security. UPI verification is essential to prevent fraudulent transactions and to protect the user’s money. UPI verification involves confirming the transaction details, such as the amount, beneficiary details, and UPI PIN, before authorizing the transaction.

Why is UPI Verification Important?

UPI transactions are quick, easy, and convenient, but they can also be risky. UPI verification is crucial to ensure the security of your money. Without proper verification, UPI transactions can be vulnerable to fraud, which can result in loss of money. UPI verification also ensures that the money is transferred to the intended recipient and not to a wrong or fraudulent account.

How to Verify a UPI Transaction?

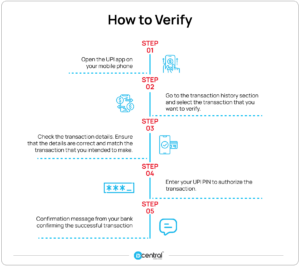

Verifying a UPI transaction is a simple process. Here are the steps to follow:

Step 1: Open the UPI app on your mobile phone.

Step 2: Go to the transaction history section and select the transaction that you want to verify.

Step 3: Check the transaction details, such as the amount, beneficiary name, and UPI ID. Ensure that the details are correct and match the transaction that you intended to make.

Step 4: Enter your UPI PIN to authorize the transaction.

Step 5: After entering your UPI PIN, you will receive a confirmation message from your bank confirming the successful transaction.

It is important to note that UPI verification is not just about verifying the transaction details but also about ensuring the security of your UPI PIN. Never share your UPI PIN with anyone, and always keep it secure.

UPI Verification API

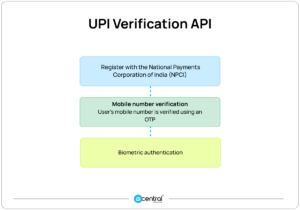

UPI (Unified Payment Interface) is a popular payment system in India that enables seamless and instant fund transfers between bank accounts. To ensure the security of these transactions, UPI relies on several verification mechanisms, one of which is the use of UPI verification APIs.

UPI verification APIs are a set of software tools that enable businesses and other third-party developers to integrate UPI verification functionalities into their own applications and services. These APIs provide a secure and reliable way to verify the identity of users and their bank account details before initiating a UPI transaction.

To use UPI verification APIs, developers need to first register with the National Payments Corporation of India (NPCI), which is responsible for managing the UPI infrastructure. Once registered, they can obtain the necessary API keys and credentials to access the UPI verification APIs.

The UPI verification APIs use a combination of different verification mechanisms to ensure the authenticity of UPI transactions. One such mechanism is the use of mobile number verification, where the user’s mobile number is verified using a One-Time Password (OTP) sent to their registered mobile number.

Another mechanism used by the UPI verification APIs is the use of biometric authentication, where users can use their fingerprint or face recognition to verify their identity. This method provides an additional layer of security and is widely used in UPI transactions.

The UPI verification APIs also include features such as real-time transaction monitoring and fraud detection. This allows businesses and developers to monitor UPI transactions in real-time and detect any financial crimes and compliance issues in regards to AML and KYC compliance.

Try IDcentral’s UPI and Bank Verification API solution