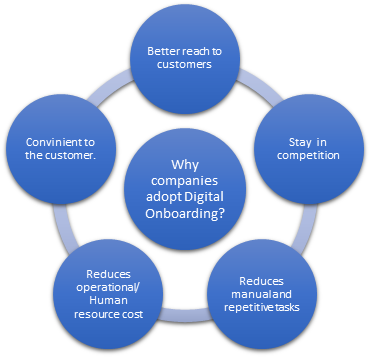

Since the rise of digital era, companies have been trying to switch to virtual onboarding from a traditional one for a multiple reason:

Traditional onboarding process requires a lot of manual efforts, involves huge operational costs and constant interaction with new customers. Apart from this it was very important for companies to adopt to new ways to stay in competition as digital onboarding increases convenience of the customers and saves their time.

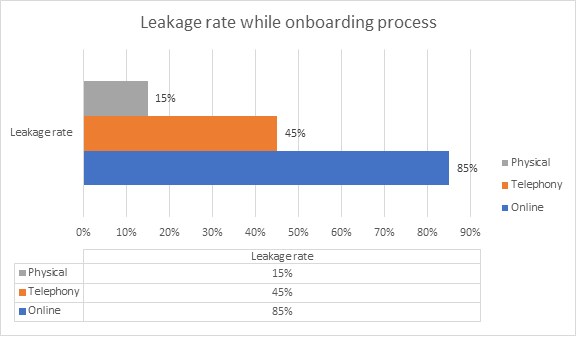

But this process of digital adoptions was slow. It had major short comings and customer apprehensions which made businesses hesitant to shift. As per a survey (Graph below) digital onboarding resulted in largescale consumer dropouts resulting in high acquisition cost and bad consumer experience.

Common reason for this large drop-out was lengthy process or safety concerns. Prior to Covid-19 my personal preference to open a bank account was driving to the nearest branch as online onboarding was too complicated and required sharing many personal details online. Covid19 acted as a catalyst for companies to adopt online onboarding. As Covid19 has imposed social distancing into our lifestyles, providing digital services that can be accessed anytime, anywhere has become a necessity across the globe. I had to adapt to this change as well. Online account openings at community financial institutions has increased by 14.5%. But so, has the rate of frauds. Cybercriminals have everything they need to create complete and convincing profiles capable of bypassing the traditional fraud detection solutions still used by many businesses.

As we move ahead into a more digital world, where everything we do is available on fingertips, it has been quite difficult for companies to keep a balance between security and user experience. A majority of consumers i.e. 92 percent demand trust, security, and data privacy, while also expecting digital journeys to be fast and frictionless. There is a constant pressure on businesses to continuously improve online journeys that provides smooth yet highly secure experience from the very first interaction. Companies that can deliver on all fronts will earn loyalty of today’s consumers.

It has become very important for companies to improve both Security and User experience. IDcentral’s ID verification solution helps enterprises achieve this with document less KYC, OCR, and liveliness check.

Your one-stop-shop for Digital Identity solutions!

Ayesha Kapoor is currently working with IDcentral (A Subex Company) as a growth Marketer. She is a post graduate in management from Symbiosis Institute of Digital and Telecom management with marketing as her majors. She is creative head who loves to read and explore different avenues in the field of Marketing, Branding and Advertising.