Before the world transitioned to digital onboarding due to cellphones, high-speed internet, and a pandemic; Banks, financial institutions, and other organisations could verify identities by physically comparing a person’s face to a photo ID. Of course, one could hardly just accept the certification at face value—no pun intended. The identification still required to be verified by employing a back-end system to compare distinctive identifiers like name, date of birth, and address to separate credit header and utility data.

What is Document Verification?

The majority of approved, verifiable papers are those that were issued by the government, such as a driver’s licence, a bank statement, or other state or federal documents. The method verifies document attributes such as stamps, watermarks, typefaces, and transport materials. Additionally, PII information from the front of the ID is compared to identical information obtained from the document’s back’s machine-readable zone (MRZ).

Applicants no longer need to be physically present for the authentication of their papers or the facial recognition of their picture ID thanks to digital onboarding. The candidate only uploads a picture of their government-issued ID and a selfie using an image capture programme on a smartphone to get a successful document verification.

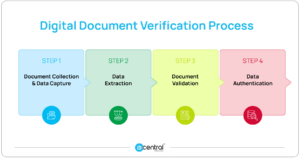

Digital document verification Process

The verification of needed papers is a straightforward procedure that begins with data collection from consumers at the point of origin and ends with data extraction from the relevant documents. Identity theft is decreased since the papers are authenticated and approved by multiple AI tests. The paper is then validated after passing through the person-in-the-loop procedure. Let’s look at each stage in more depth below:

Step 1 : Document Collection & Data Capture

The initial stage is submitting the necessary paperwork. Customers are requested to send high-quality images or videos of the necessary ID documents. The paper is searched for information, including the encrypted data, by AI and algorithms, which then identify it.

The papers are pre-processed and made ready for the following step in the first phase. To provide improved data extraction in the following stage, this includes checking the document boundaries, de-skewing the photos, and enhancing the colour and brightness of the image.

Step 2: Data Extraction

The necessary data is selectively pulled from the documents in the second stage. Users may choose the information that is vital and ignore all the other useless information with the help of clever AI-based document verification solutions.

Using an AI-based OCR solution is preferable to using a straightforward OCR programme since it turns your complete document into a structured informative document that can be immediately fed into subsequent data sources as needed. At this stage, you may also categorise the papers according to their templates and guarantee flawless client document documentation.

Step 3: Document Validation

It is necessary to determine whether the document and the information shown are still valid in order to validate the data gathered from the scans. You can compare the extracted information against any data source based on the retrieved data to verify its accuracy. For instance, the department in charge of processing loans could wish to see if the applicant already has loans at the same bank. Document verification is essential to lowering fraud and identity theft.

Some of the verification tests that can be automated for identifying documents are:

- Identification of faces and orientations

- Detecting edges and cropping

- Back-to-front correlation

- Cross-referencing hundreds of international IDs

- Analysis of colour spaces

- Headshot reliability

- Matching selfie to ID image

Step 4: Data Authentication

The documents that have errors detected against them are put via an approval procedure as a last step. The human-in-loop verification process is a common name for this combination of manual and automated processing. The documents are validated after being thoroughly checked.

How to automate the digital document verification process?

Verify that the security measures are installed properly

Every ID document has a special set of security characteristics, including holograms, watermarks, logos, and microprint. A good initial step in determining whether the document is authentic is to make sure that certain security elements are present where they belong. To check the document’s security features, all that is required is a clear image.

A crisp, horizontally aligned picture of the paper should be the result.

To check for consistency, compare the ID data

Each ID has the person’s personal information encoded in some fashion, such as a barcode or a Machine Readable Zone (MRZ). Any discrepancy between this data and the data written on the remaining pages of the document, known as the Visual Inspection Zone, or VIZ, is proof that the document has been tampered with.

Compare the user’s face to the document’s portrait

Comparing an ID photo to a customer’s submitted selfie is another technique to confirm the legitimacy of a document. The user is the true owner of the uploaded document if the attributes on these two photos match.

Designing technologies and procedures to aid in the development of electronic documents is known as document process automation. These contain logic-based programs that piece together new documents from bits of text and/or data that exist already. In some businesses, it is becoming more common to put together letters, contracts, and legal documents using this method. Automation solutions enable businesses to reduce the amount of data entered, the amount of time spent proofreading, and the dangers posed by human mistakes.

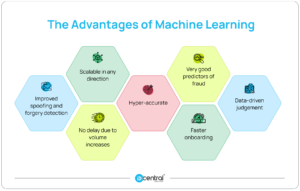

Document Verification Services & Machine Learning

Large datasets are necessary for machine learning (ML) approaches to achieve high accuracy, and the amount of training data is a key factor in a model’s predictive ability. Such information is used by machine learning models to train themselves and learn new things continuously, improving performance. Socure’s supercharged machine learning categorization is reinforced with data from more than 400 sources and trained on 700 million “known good” and “known bad” identities. The advantages of machine learning for document verification are as follows:

- Improved spoofing and forgery detection

- Scalable in any direction

- No delay due to volume increases

- Hyper-accurate

- Very good predictors of fraud

- Data-driven judgement

- Faster onboarding

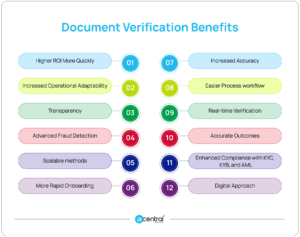

Document Verification Benefits

Businesses that are seeing some success as a result of their expansion and popularity of their ideas must combat the intricate network of fraudsters that is constantly present at their online portals. The security of commercial portals is multiplied by 10 when AI is used for ID verification, and companies gain an advantage over those looking to commit fraud. AI improves the human ability to interpret data when combined with human intelligence, allowing businesses to handle information intelligently and avoid being deceived. The following are some advantages that machine learning has for document verification:

Higher ROI More Quickly

Instead of taking months or years, automation document processing solutions may be set up and taught in days or weeks. Enterprises may use automated document processing for a variety of documents with a reduced total cost of ownership and faster ROI than with traditional technologies. In less than three months, lost revenue from fraud may be recovered completely.

Increased Operational Adaptability

Rapid document modelling and training are made possible by AI with deep learning, allowing for the swift addition of fresh, unprocessed documents to the document processing system. Additionally, with shorter lead times, businesses are better able to seize new possibilities by developing new document processing apps without adding more people.

Transparency in Compliance and Quicker Operational Responsiveness

Automation powered by AI can provide “human-in-the-loop” validation, which provides categorization and extraction results for documents to the person submitting them. As a result, information may be verified and corrected quickly and effectively in almost real-time. When interacting with clients, partners, or other external stakeholders, front-line staff may easily make modifications or ask for further details. This helps everyone engage in a business process by saving time and ensuring improved data quality and openness.

Advanced Fraud Detection

Using Photoshop, EXIF, or forgery detection, document processing software with enhanced fraud detection help identify phoney documents. It constantly scans the papers for irregularities that could point to any kind of manipulation.

Scalable methods

The whole document verification process is automated using document verification software, making it uniform and scalable across all regions.

More Rapid Onboarding

The client onboarding process may be cut down from days to minutes using an automated onboarding procedure. Document verification can speed up and nearly 100% accurately improve the client onboarding process.

Increased Accuracy

Software for document verification that is incredibly accurate, leverages AI to improve OCR technology to extract data from client papers. With over 99% accuracy, it can recognise photos, more than 200 languages, and handwriting. Additionally, the accuracy of the entire process rises to above 99% when there is no human involvement other than in situations that are marked.

Easier Process workflow

For a smooth client experience, remote ID verification may be completed at any time and from anywhere around the globe.

Real-time Verification of Online Documents

For banks and non-bank financial organisations, this is the ideal way to cut costs, time, and errors while also improving the entire client experience. To increase conversion rates and decrease drop-offs, user authentication should happen within 30 to 60 seconds. With the use of this technology, a variety of papers, such as bank accounts, bank statements, proofs of address, tax returns, and identities, may be instantly verified in real-time.

Accurate Outcomes

An accuracy rate of 98% is achieved for the prevention of identity fraud using AI-powered verification.

Enhanced Compliance with KYC, KYB, and AML

By reducing the onboarding time, you may increase your KYC, KYB, and AML compliance while also enhancing the user experience.

Digital Approach

The digital procedure is fully automated for more productivity and less manual labour. Instantaneous and real-time verification is offered by this technology everywhere in the world, at any time.

Need for Document verification

All online companies struggle greatly with online identity theft.

For instance, 47% of US individuals reported financial identity theft in the US alone. Identity theft-related losses totalled $502.5 billion in 2019, and they rose by 42% to $712.4 billion in 2020. In 2021, losses are anticipated to rise once again to $721.3 billion.

An essential tool in confirming a customer’s identification is document verification. Online document verification is required for both account opening and adhering to KYC standards. By confirming the legitimacy of ID papers throughout the customer onboarding process, document verification may assist businesses in rapidly and securely verifying new clients.

Organizations may more easily cut the time required for client onboarding to a few minutes thanks to online document verification technologies. Teams may carefully extract data from ID papers using AI-enhanced OCR software, and then merge it with their current CRM system to create detailed customer profiles.

Identity document verification for KYC

Verifying identity documents is crucial in the digital economy. Consumers demand easy access to the growing number of online services and goods that are being offered. Additionally, they want all of this without having their security and identity compromised.

Businesses, on the other side, are interested in knowing who is accessing their doors and using their goods and services. Digital identity can help people attain this freedom of privacy and security. This pattern will persist, and in the future, digital identification document verification will hold the key to more practical and speedy internet access without sacrificing privacy and security.

In this aspect, a decentralised strategy will aid in online identity protection. Customers will benefit from privacy, security, and easy access to digital goods and services by doing this. As an alternative, companies gain from this and have access to more customers.

Identity verification innovations will have a significant influence on how we now see digital identity. The new strategies will enable us to combat bad actors, offer security, and improve the convenience of our lives. Let’s take a closer look at a few of these developments.

Growing Digital Identities

In the digital age, conventional approaches to identification document verification will be obsolete. Currently, physical forms of ID papers, such as ID cards, licences, and passports, are issued. These materials are delivered through a centralised system that adheres to strong security and privacy regulations.

As more services are now provided online, several trials are transitioning from physical identity cards to digital IDs. To build Canada’s digital identity system, the Digital Identification and Authentication Council of Canada (DIACC) is conducting several tests.

Maintaining high levels of security for digital IDs is a significant problem, though, as they may be readily falsified or counterfeited if not adequately protected. There may not be a perfect answer for this at this time, however, it will find its way in the future.

Models that are not centralised will take their place

User control is restricted and security risks arise with centralised databases. For instance, all users’ data is kept in one location in a centralised database, like a credit bureau. As a result, if the data of one individual is compromised, so too is the data of other users.

Decentralized databases, on the other hand, provide people with complete control over their identification. Consumers will be able to govern a business because of decentralised structures.

Individual Biometrics

Regarding Facial biometrics, several breakthroughs have already occurred. Biometrics, however, are more pervasive than anticipated. With certain recent improvements, their use will only rise in the future. Pins and passwords are increasingly likely to become a thing of the past as the use of biometrics rises.

Biometrics are hard to manipulate. Because of biometrics, fraudster attacks will be challenging to execute. Future biometric usage will also include behavioural biometrics. Analysis of a person’s distinctive cognitive activity is the subject of behavioural biometrics. It will make it easier to tell the difference between lawful clients and illicit activity.

ML and AI

The future of identity verification and fraud protection will use artificial intelligence (AI) and machine learning (ML), both of which will play a significant role. Businesses will be able to safeguard the identities of their users by utilising AI and ML. Increasing the usage of AI will speed up and secure client onboarding while decreasing fraudulent assaults.

Try IDcentral’s Document Verification solution. Request a demo

Sumanth Kumar is a Marketing Associate at IDcentral (A Subex Company). With hands-on experience with all of IDcentral’s KYC and Onboarding Technology, he loves to create indispensable digital content about the trends in User Onboarding across multiple industries.