Introduction

Transaction monitoring in the realm of Anti-Money Laundering (AML) is a critical process that financial institutions employ to detect and prevent illicit activities such as money laundering, terrorist financing, and fraud. As regulatory scrutiny intensifies globally, the importance of robust transaction monitoring systems cannot be overstated. This blog delves into the fundamentals of transaction monitoring, its challenges, implementation strategies, and future trends, aiming to provide a comprehensive overview for professionals in the financial sector.

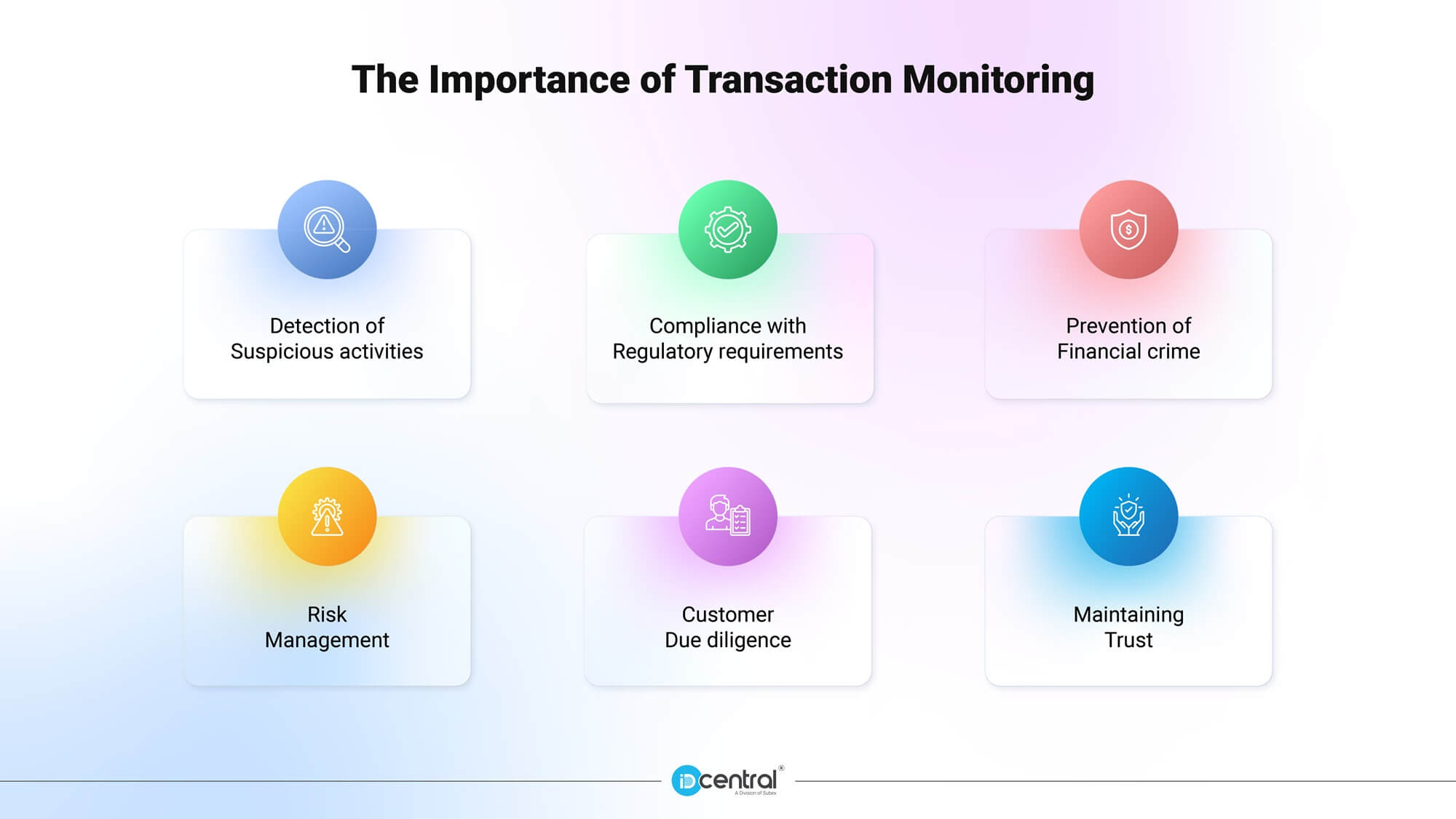

The Importance of Transaction Monitoring

Transaction monitoring is one of the most effective tools in anti-money laundering programs because it plays a vital role in identifying and preventing potentially illicit activities such as terrorist financing, arms trading, human trafficking and corruption.

Any business at risk of facilitating money laundering must ensure it complies with the legal requirements imposed by authorities. Transaction monitoring in AML works to provide the following benefits:

- Detection of suspicious activities: Transaction monitoring enables financial institutions to detect unusual or suspicious activities that could indicate money laundering, terrorist financing or other financial crimes. By analyzing transaction patterns and behaviors that deviate from a customer’s typical activity, institutions can identify potential risks and flag them for further investigation.

- Compliance with regulatory requirements: Financial institutions are required by law to have robust AML programs; transaction monitoring is critical to these requirements. Failure to effectively monitor transactions can result in significant legal penalties, reputational damage and financial losses.

- Prevention of financial crime: By identifying suspicious activities early, transaction monitoring allows institutions to take timely action to prevent potential money laundering or terrorist financing. This protects the institution and contributes to the broader fight against financial crime and the integrity of the greater economic system.

- Risk management: Transaction monitoring helps financial institutions manage risks by providing insights into customer behavior and identifying areas of potential exposure. This information can inform risk management strategies and help institutions allocate resources more effectively.

- Customer due diligence: Ongoing transaction monitoring is essential to customer due diligence. It ensures that institutions continuously understand their customers’ activities and can reassess the risk levels associated with different customers over time.

- Maintaining trust: By demonstrating a commitment to preventing money laundering and complying with AML regulations, financial institutions can support and enhance trust with customers, regulators and the public. This trust is fundamental to the stability and reputation of the financial sector.

Key features of a TM System

Staying ahead of Anti-Money Laundering (AML) regulations and efficiently identifying suspicious activity requires a robust transaction monitoring system. Here’s a breakdown of key features that empower your AML efforts:

- Real-time Threat Detection: Imagine a system that combines advanced digital footprinting, internal device intelligence, and real-time AML screening against sanctions, crime, and watchlists. This provides a holistic view of both new and existing customers, helping you stay compliant and expedite investigations.

- Customizable Rules Engine: AML regulations are crucial, but flexibility is key. Tailor transaction monitoring rules based on your specific risk tolerance. This precision helps reduce false positives while maintaining accuracy and security.

- Proprietary Data Advantage: Leverage your unique data! Internal transaction history, behavioral analytics, and risk scoring models built from your data offer deeper customer insights and more precise risk assessments.

- Streamlined Workflows with API Integrations: Eliminate data silos and manual processes. Seamless API connections with external databases for sanctions, watchlists, and PEPs ensure smooth data flow and automation, minimizing errors and speeding up response times.

- Effortless Regulatory Reporting: Imagine a system that facilitates seamless documentation and collaboration throughout the case management process, with built-in cross-checking capabilities for efficient reporting.

- Unified Fraud and AML Case Management: Connect your fraud and AML data for faster investigations and streamlined case management. This powerful synergy unlocks operational efficiency and empowers your teams to focus on strategic, data-driven risk management strategies.

By implementing these features, your AML transaction monitoring system becomes a powerful tool to combat money laundering and protect your institution.

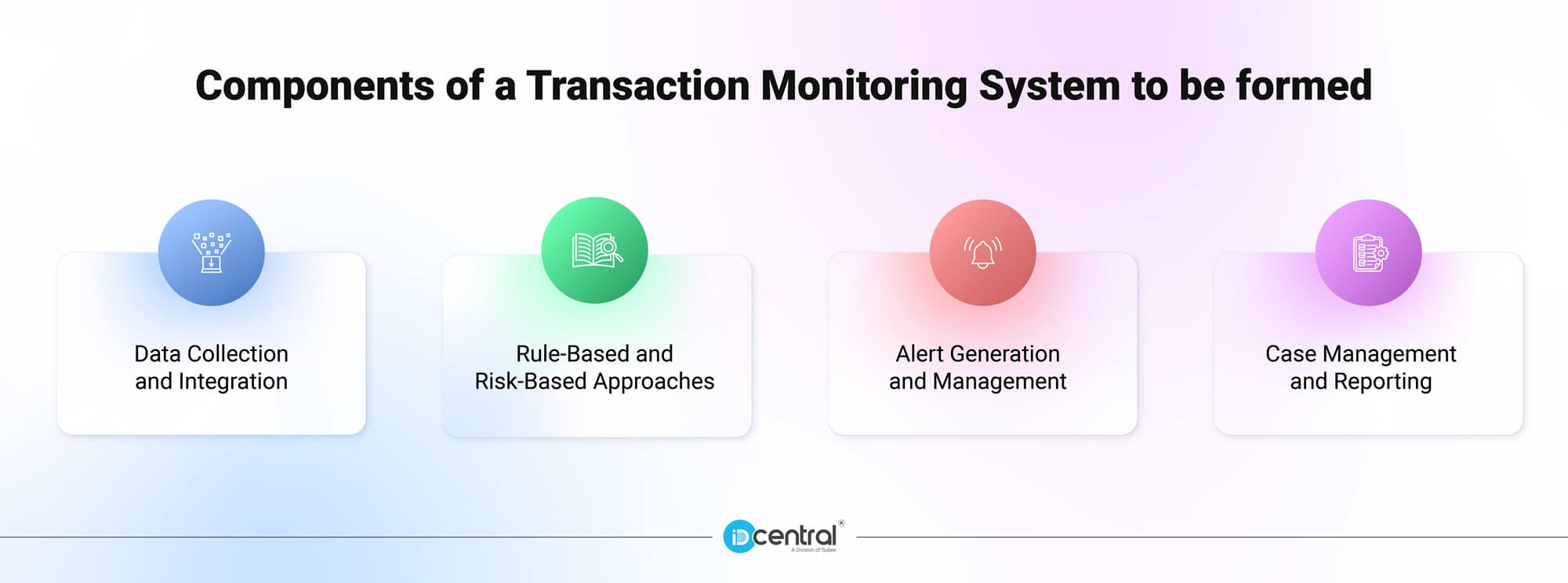

Components of a Transaction Monitoring System to be formed

1. Data Collection and Integration: The foundation of any transaction monitoring system is the comprehensive collection of data from various sources, including customer profiles, transaction histories, and external data feeds.

2. Rule-Based and Risk-Based Approaches: Traditional transaction monitoring systems use predefined rules to flag suspicious activities. However, modern systems increasingly adopt a risk-based approach, prioritizing resources on high-risk transactions.

3. Alert Generation and Management: When a transaction is flagged as suspicious, the system generates an alert. These alerts must be managed effectively to differentiate between false positives and genuine threats.

4. Case Management and Reporting: Compliance teams investigate alerts, and if deemed suspicious, the cases are reported to the relevant authorities. Effective case management systems streamline this process, ensuring timely and accurate reporting.

How to Set Up Transaction Monitoring in AML

Setting up AML transaction monitoring involves several key steps to ensure compliance with regulatory requirements and address the unique needs of your business. Here’s a comprehensive guide:

1. Customize Rules Based on Regulatory Requirements

Identify and understand the specific regulatory requirements you need to comply with. Different regulatory agencies may have varying requirements, so it’s essential to adjust your monitoring system to accommodate all relevant guidelines.

2. Adjust Customization for Your Business

Tailor your transaction monitoring rules to fit your company’s unique business model. Consider setting up rules to monitor the following:

Large Transactions: Establish thresholds to monitor transactions exceeding a certain amount, as these can indicate high-risk activities.

Unusual Patterns: Detect abnormal transaction patterns or behaviors that deviate from a customer’s typical activity, which may signal suspicious activities.

Structuring or Smurfing: Identify multiple smaller transactions designed to evade reporting thresholds, a common tactic used in money laundering.

Rapid Movement of Funds: Monitor swift movement of funds between accounts or sudden increases in outflows, which could suggest illicit activity.

High-Risk Countries: Flag transactions involving countries known for money laundering or terrorist financing to ensure additional scrutiny.

Politically Exposed Persons (PEPs): Monitor transactions involving individuals with political influence to prevent corruption or bribery.

Sanctions Screening: Check transactions against government-issued sanctions lists to identify dealings with restricted entities and comply with international sanctions laws.

By following these steps, you can establish a robust transaction monitoring system that not only meets regulatory requirements but also effectively mitigates the risk of money laundering and related financial crimes.

Challenges in Transaction Monitoring

1. High Volume of Transactions: Financial institutions process millions of transactions daily, making it challenging to monitor each one effectively.

2. False Positives: A significant challenge is the high number of false positives, where legitimate transactions are incorrectly flagged as suspicious, leading to increased operational costs and inefficiencies.

3. Evolving Tactics: Criminals continuously adapt their tactics to evade detection, necessitating constant updates and improvements to monitoring systems.

4. Regulatory Changes: Keeping up with the ever-evolving regulatory landscape is a continuous challenge for financial institutions.

Why Transaction Monitoring is Crucial in Fighting Financial Crime

Transaction monitoring plays a crucial role in preventing financial crimes, and its importance cannot be overstated:

- Transaction monitoring serves as a sophisticated surveillance system within financial institutions, meticulously examining transactions to identify anomalies potentially linked to money laundering, terrorist financing, or other illicit activities.

- The very presence of transaction monitoring acts as a powerful deterrent. Criminals attempting to launder money or finance terrorism are dissuaded by the knowledge that their transactions are under constant scrutiny, significantly increasing the risk of detection and apprehension.

- Financial institutions have a legal obligation to adhere to Anti-Money Laundering (AML) regulations. Effective transaction monitoring plays a critical role in ensuring compliance with these regulations, mitigating the risk of substantial financial penalties and potential reputational damage.

- The significance of transaction monitoring is further emphasized by the Financial Action Task Force (FATF), a preeminent international organization advocating for robust AML/CFT (Countering the Financing of Terrorism) practices. Their recognition highlights the essential role transaction monitoring plays in safeguarding the financial system from criminal activity.

Conclusion

Transaction monitoring is a vital component of AML programs, playing a crucial role in detecting and preventing financial crimes. While he challenges are significant, advancements in technology and best practices offer promising solutions. Financial institutions must continue to invest in robust transaction monitoring systems, stay abreast of regulatory changes, and foster a culture of compliance to safeguard the integrity of the global financial system.

By understanding and addressing the complexities of transaction monitoring, financial institutions can better protect themselves against the risks of financial crimes and contribute to a safer and more secure financial environment.

IDcentral offers a comprehensive AML screening and transaction monitoring solution designed to meet the rigorous demands of regulatory compliance. With advanced AI technologies and real-time monitoring capabilities, our solution empowers financial institutions to detect and mitigate AML risks effectively. Whether it’s through automated risk assessment, continuous updates of global sanction lists, or seamless integration with existing systems, IDcentral provides the tools necessary to safeguard against financial crimes and ensure regulatory adherence.

Talk to our experts to explore how our AML screening solution can safeguard your business!Book a demo

Mohini Sahu is a Digital & Content Marketing Executive at IDcentral (A Subex Company). She specializes in crafting engaging content on KYC and Onboarding Technology. With a thorough understanding of diverse industries, she creates insightful content on emerging trends and best practices.